There are a ton of brokers for traders to choose from so we put together a detailed list of the best online stock brokers for 2022.

Finding the right brokerage firm for your trading demands just got a little simpler, thanks to our research. We poured through a long list of brokers and compared them in the most important areas. Here are the winners by category:

- Active trading

- Commissions

- Platform

- Account size

Best for Active Traders: LightSpeed Trading

For high-volume traders, we have chosen Lightspeed, a division of Lime Brokerage.

Lightspeed is known for its many trading platforms, day-trading services, and discounts for frequent traders. Although it doesn’t yet provide trading in cryptocurrencies, it does offer futures and options.

Lightspeed’s trading platforms are designed for different types of traders.

Here they are with their highlights:

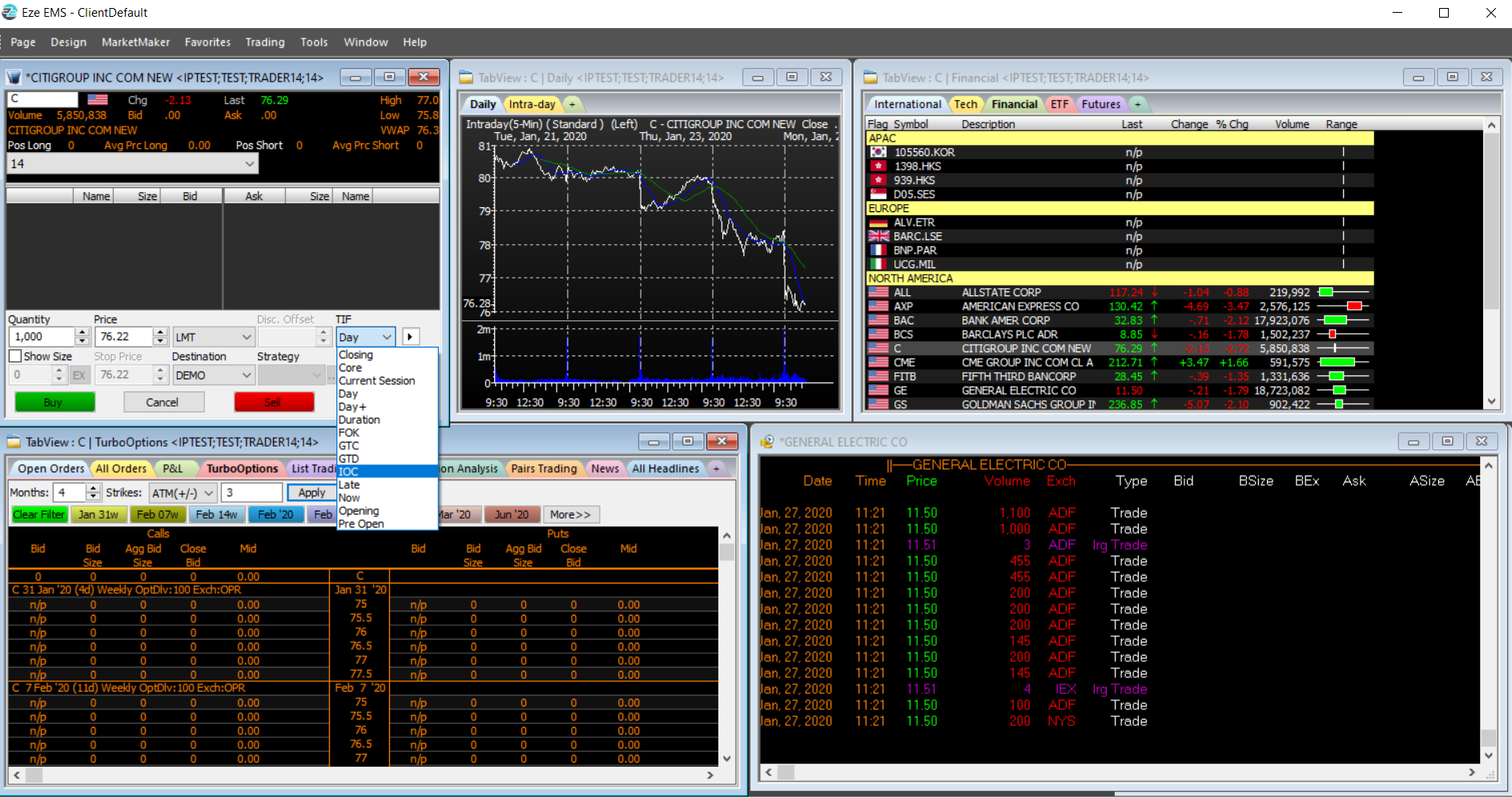

- Eze EMS (the former RealTick Pro): This one is designed for futures traders. And in fact, it’s the only platform at Lightspeed capable of trading the asset. It comes with streaming Level II data, watchlists, hot keys, direct-access routing, and basket order entry.

- Livevol X: This platform offers market scanners and window linking, features that Eze EMS doesn’t offer. But it doesn’t come with extended-hours trading, which is available on Eze EMS.

- Sterling Trader Pro: This software offers API functionality and is capable of handling multiple accounts. It has a high number of market venues.

- LS Trader: If you need 40 custom layouts, then LS Trader is your platform. The program also has a very good option scanner.

Although Lightspeed does charge software fees for some of the above platforms, a few of them are eligible for rebates based on monthly volume.

Speaking of monthly volume, Lightspeed’s commission schedule for stocks, ETFs, and options varies by volume. Accounts that trade more than 15 million equity shares in a month pay just 0.1¢ per share. Options are as low as 20¢ per contract, and futures contracts are a flat $1.29 each per side.

Best for Cheapest Commissions: Robinhood

Robinhood goes a step further than TradeStation by eliminating per-contract fees on option trades. The firm has even eliminated exercise and assignment fees and all commissions on crypto trades.

It is a true zero-commission broker.

And it goes without saying that Robinhood has no account fees of any kind.

But Robinhood hasn’t cut too many corners to get to zero fees. It has a browser platform that delivers some useful features, including:

- Full-screen charting: With four technical studies and two graph styles. Drawing tools, comparisons, and company events are unfortunately missing.

- Order ticket with five order types: They are market, limit, stop loss, stop limit, and trailing stop (in both $ and % terms).

- Options trading: Just calls and puts on the computer platform, although you can create your own multi-leg order. Robinhood has its own form of option chains, which are different from traditional chains. Instead of calls on one side and puts on the other, you select calls or puts with discrete buttons. Then you choose buy or sell.

- Watchlists: An infinite number can be created. With Robinhood’s software, it’s possible to add a name to each list and even a unique icon.

- Popular lists: These are collections of stocks and ETFs divided by theme. Examples include upcoming earnings, healthcare supplies, and tech. Results can be sorted by price and market cap.

- News articles: Robinhood delivers recent stories from Reuters, CNBC, MarketWatch, and Bloomberg.

We also like Robinhood’s fractional-share trading service, which permits whole dollars to be traded instead of whole shares. Only a handful of other broker-dealers today offer this really great service.

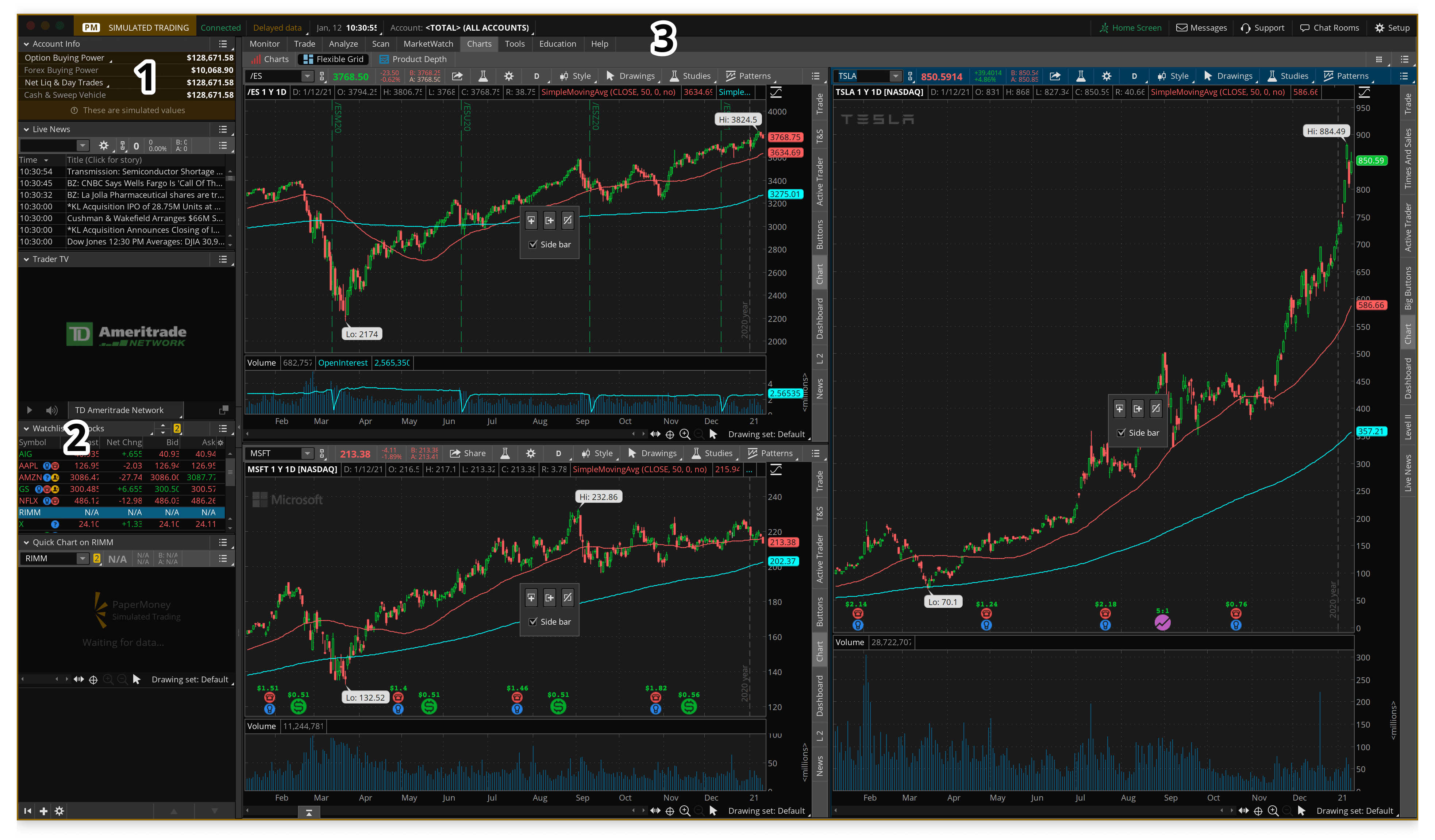

Best for Trading Platform/Technology: Ameritrade

TD Ameritrade’s thinkorswim platform is one of the most powerful and intuitive platforms on the market.

IMAGE CREDIT

It is packed full of sophisticated features including robust charting, advanced order entries, direct access routing, and plenty more customizable features.

There is a bit of a learning curve but there are plenty of tutorials on the internet to help you get started.

Best for International Trading: Interactive Brokers

Not only does Interactive Brokers have options, forex, CFDs, and futures, you can actually trade them on foreign exchanges.

IB offers direct trading on global exchanges for stocks, too, straight from a single platform. It’s a really convenient service.

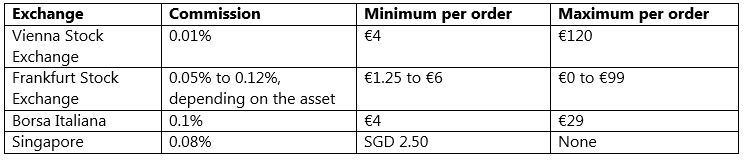

It’s worth noting that while Interactive Brokers now offers $0 commissions, this great price only applies to US-listed equities. Foreign securities do have commissions, and they vary quite a bit by exchange and by pricing schedule.

IB offers both tiered and fixed-price schedules.

Here are some examples for stock, ETF, and warrant trades on the tiered schedule:

The broker’s fixed-commission schedule looks like this:

Interactive Brokers offers many more foreign exchanges than those listed here. To trade on any exchange, you simply need to download and install Trader Workstation. This is the firm’s desktop software.

It offers many advanced features, including:

- Full-screen charting with right-click trading

- Many option tools

- Bloomberg TV

Best for Small Accounts: Capital Markets Elite Group

If you want to day trade but don’t have $25,000 to deposit, we have a solution for you. Say hello to Capital Markets Elite Group (CMEG).

Based in Trinidad and Tobago, this broker doesn’t have any pattern-day trading requirements.

To get started, you just need a $500 deposit. Even better, the brokerage firm offers 4:1 day-trading leverage for stocks priced at $4 and higher. For accounts with assets of at least $2,500, CMEG offers a very low 16% maintenance requirement on intraday positions. This number reverts to 50% overnight, and interest is charged on such positions.

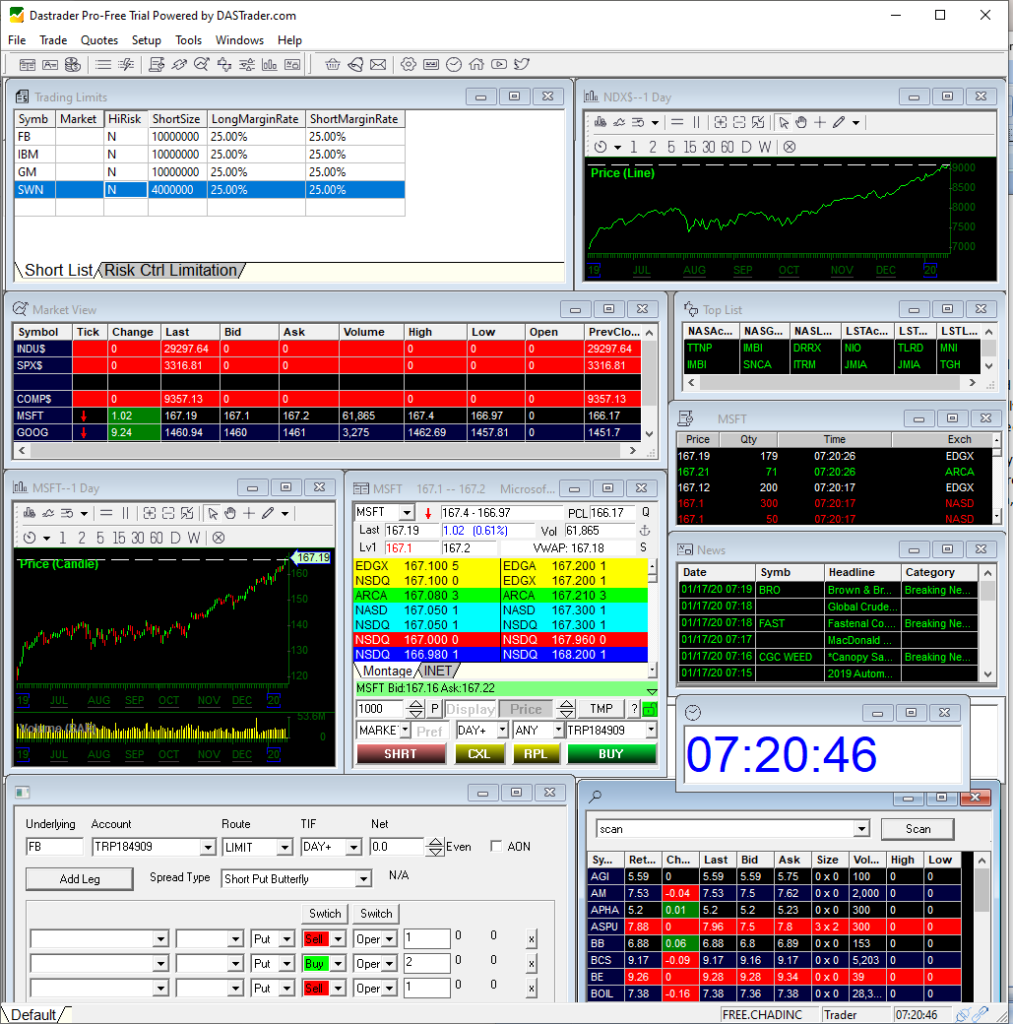

Besides its excellent margin numbers for small accounts, CMEG also provides access to DAS Trader Pro. This software platform is not available at Lightspeed.

Highlights include:

- Hot keys

- Almost 20 routes

- Order execution in milliseconds

- Level II quotes

Although CMEG does charge for DAS Trader Pro, rebates are available for active traders.

CMEG offers two account types: active and standard. DAS Trader Pro is only available in an active account. Standard accounts aren’t left out in the cold, though, as they can use Traders Elite Terminal. This platform is the same software that Interactive Brokers uses.

The one downside of Capital Markets Elite Group is that it only offers trading in equities. Although it says it has plans for options, forex, CFDs, and futures, it hasn’t delivered them yet.