As a full-time day trader, it’s inevitable that you will get caught in circuit breaker halts from time to time. That means it’s important to understand why halts happen, what causes them, and how to deal with them.

Any stock in the market can get halted at any time. The two most common reasons a stock will be halted is Pending News, or for a Volatility Pause. When a stock is halted it cannot be traded by anyone.

The risk with halts is that when the stock reopens, it can reopen at any price. There really isn’t much you can do if you get stuck in a halt except wait until trading resume.

A halt pending news can last hours or even longer, while Volatility Pauses are usually 5min, but can be as long as 10-min.

Circuit Breaker Halt Types

Code: LUDP – Volatility Trading Pause: Stocks can also spike up or down and get halted on a volatility halt or circuit breaker.

Code: T1 – News Pending: The company has requested trading of the stock be halted while they release material news. This can be good or bad. When the stock reopens, the market will react to the news. Sometimes stocks that are moving quickly on rumors will get halted while the company comes out and responds to the rumor. That’s why holding stocks that are moving on rumors can expose you to halt risk.

Code: H10 – SEC has suspended trading in this stock (common among penny stocks and companies suspected of stock promotion or fraud)

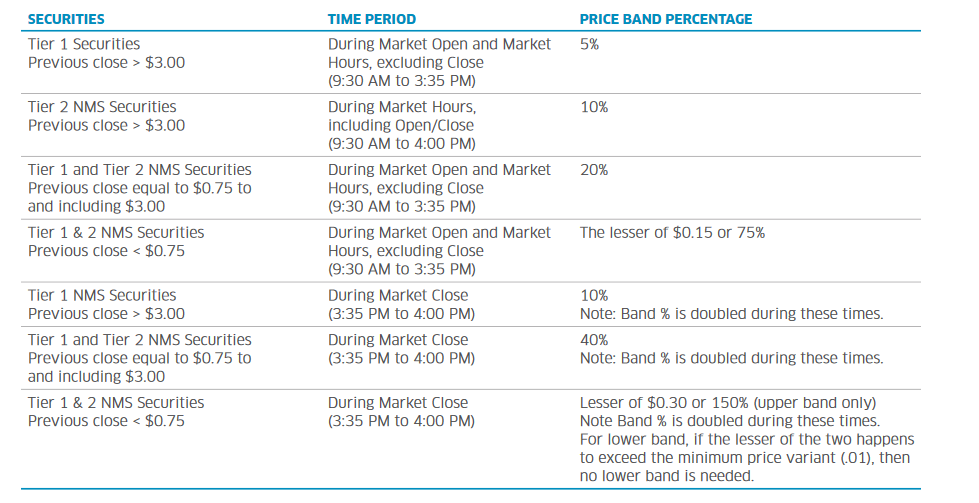

This is a 5min halt to pause trading for stocks priced above $3 and that move more than 10% in a 5min period.

Stocks under $3.00 have different circuit breaker rules, and S&P 500 stocks and Indices also have different rules.

When a stock is halted, you cannot trade it, you have to wait.

Circuit Breaker Halt: Volatility Pause Code: LUDP

A halt on a Volatility Pause is one of the most common types of circuit breaker halts in the market. If a stock moves up or down too quickly within a 5min period it can cause an automatic circuit breaker halt that will pause trading for 5min.

This helps smooth volatility in the market and prevent flash crashes. It forces traders to take a 5min time out, research the stock, news, etc. Often times if a stock is spiking up and is halted, it will reopen higher.

Inversely, a stock selling off will often open lower.

I have seen examples where a stock spikes up 10% in 2min and gets halted for 5min, reopens and immediately spikes another 10% and gets halted a 2nd time for 5min, reopens and spikes another 10% and gets halted for 5min a third time, reopens, sells off 10%, and gets halted going back down.

This type of extreme volatility is typically the result of breaking news such as FDA announcements, earnings leak, buyout offers, activist investor stakes (Bill Ackman, Carl Icahn, research reports (Citron Research, Muddy Waters Research), etc.

At it’s core, the type of volatility that causes circuit breakers is what all day traders are looking for because it presents a huge amount of potential.

Tier 1 Stocks: All securities in the S&P 500 or the Russell 1000 indexes. In addition, Tier One includes all exchange-traded products that average at least $2 million a day in daily trading. Bands are 5-10% for stocks above $3.00

Tier 2 Stocks: All other national market securities, including rights and warrants, and smaller ETP products. Bands are 10-20% for stocks above $3.

Reference: Nasdaq Trader

Circuit Breaker Halt: Pending News Code: T1

Holding a stock that is Halted Pending News can be a little scary. It means that the company is choosing to release material news in the middle of the trading day, instead of after hours.

In my years or trading I’ve found the most common reason a stock will be halted mid-day Pending News is because the stock was making a huge move on rumors.

Maybe rumors of bankruptcy is driving the stock down, or rumors of a buyout is driving the stock up.

In either case, the company feels they must respond to the rumors. If they deny the rumor, the stock will often quickly reverse directions.

As a day trader you have to understand that stocks spiking on rumors or for no apparent reason are always at risk of getting halted pending news. It shouldn’t be a surprise if and when it happens.

Circuit Breaker Halt: SEC Trading Suspension Code: H10

This one is bad. If a stock is halted by the SEC it’s typically because it’s a penny stock, OTC stock, and it’s being used by criminals to front load or manipulate the price of the stock.

These stocks can be halted for days or weeks, and often resume trading at a fraction of the price before the halt. Sometimes they drop as much as 80%. This is a good reason to use extreme caution when you’re trading penny stocks.

Circuit Breaker Halt: Additional Information Requested Code: T12

This is typically another bad halt which usually happens when a stock has run up a lot but there is no reason backing the run.

This usually happens on pump and dumps or huge short squeezes and in most cases when this halt is lifted the stock will come plummeting down because there is nothing to support this drastic move.

Trading Circuit Breaker Halts is incredibly risky, but can be profitable!

Black Monday (round 2) with 1200 circuit breaker halts

On August 24th 2015, Black Monday Round 2, there were over 1200 circuit breaker halts when the market opened. It was the most extreme amount of volatility across the entire market I’d ever seen as a trader.

The market tanked over 1000 points causing circuit breakers on the way down, then it experienced such a massive bounce off the lows it caused additional circuit breakers coming back up!

The purpose of these circuit breakers and 5min volatility pauses were to prevent a full market crash. While the market still dropped 1k points it could have been much worse. – CNN Money